Table of Content

Every company will try to sell themselves to clients. We are going to take the guessing out of which ones can be an excellent fit and which ones you must avoid. Females, in all age brackets, are likely to pay slightly lower than males. A High Loss Ratio indicates that the businesses underestimated the frequency and severity of losses and how much premium would be needed to cover them. A high loss ratio is an effective indicator of future price will increase.

Drivers in Altus can count on average rates of $817 per year. But Oklahoma City car insurance costs are fairly low, despite the very fact that it’s the most important metropolis within the state—and Tulsa automobile insurance coverage prices are even decrease. High crime rates, extreme climate patterns, and different components can all drive up the price of insurance coverage in your ZIP code. In common, drivers in massive cities pay larger rates on car insurance coverage than rural drivers, since higher inhabitants density usually interprets to more car accidents.

Cheap Oklahoma Automobile Insurance For Younger Drivers Ages 18 To 25

A lower credit score rating can raise your fee by a quantity of thousand dollars. The average Oklahoma resident has a credit score score of 656, which is a “near-prime” rating. When you've a larger purchase to make, similar to a automobile or home, your credit score follows you. If you've better credit you can usually get a greater rate of interest. Medical funds can be added to your coverage to cowl medical bills for anyone in your vehicle on the time of the accident.

It isn't a surprise it was the setting for the film Twister . Jeffrey Johnson is a legal author with a concentrate on personal injury. He has labored on personal harm and sovereign immunity litigation in addition to expertise in family, property, and criminal regulation. From the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina.

How Much Do Oklahoma Residents Spend On Auto Insurance?

Unfortunately, it’s unlawful to drive a salvage-title car in Oklahoma, even when the vehicle runs. If you may have a automobile mortgage or lease, your lender or leasing firm will most likely require you to have these insurance varieties. American Farmers and Ranchers offer low rates for Oklahoma parents who add a teen.

We don't embrace the universe of firms or monetary provides that could be out there to you. Many drivers assume rain and darkish convey accidents, but as you can see from the table above, that is not at all times the case. Most accidents in Oklahoma happen in lighted, normal situations.

Low Cost Oklahoma Automotive Insurance Coverage For Drivers With Poor Credit Score

This protection might be paid out no matter who is at fault. As we talked about earlier, legal responsibility insurance will cover the opposite particular person if you're at fault. Comprehensive and collision work slightly in one other way.

Oklahoma additionally has the beneath restrictions for teen drivers. You must maintain proper licensing, similar to you must maintain insurance in your vehicle. We are going to break down the licensing legal guidelines of Oklahoma and discover out what happens should you resolve to drive without insurance.

To find the most cost effective auto insurance corporations in Oklahoma, we used charges from Quadrant Information Services, a provider of insurance coverage data and analytics. The fee additionally includes collision and comprehensive with a $500 deductible. The average cost of full protection automotive insurance coverage in Oklahoma is $1,873 per 12 months, based mostly on Bankrate’s evaluate of quoted annual premiums.

In each conditions you have comfort, but it is necessary that you've safety so that you are calm always. Driving with a suspended license in Idaho will lead to a rise within the suspension size and possible jail time. The higher your deductible, the less you’ll pay month to month. If you can afford a higher deductible, this is an easy way to unlock some further cash circulate, however it’s never price it to determine on a deductible you couldn’t realistically pay.

Low-cost Automobile Insurance Coverage In Oklahoma Metropolis

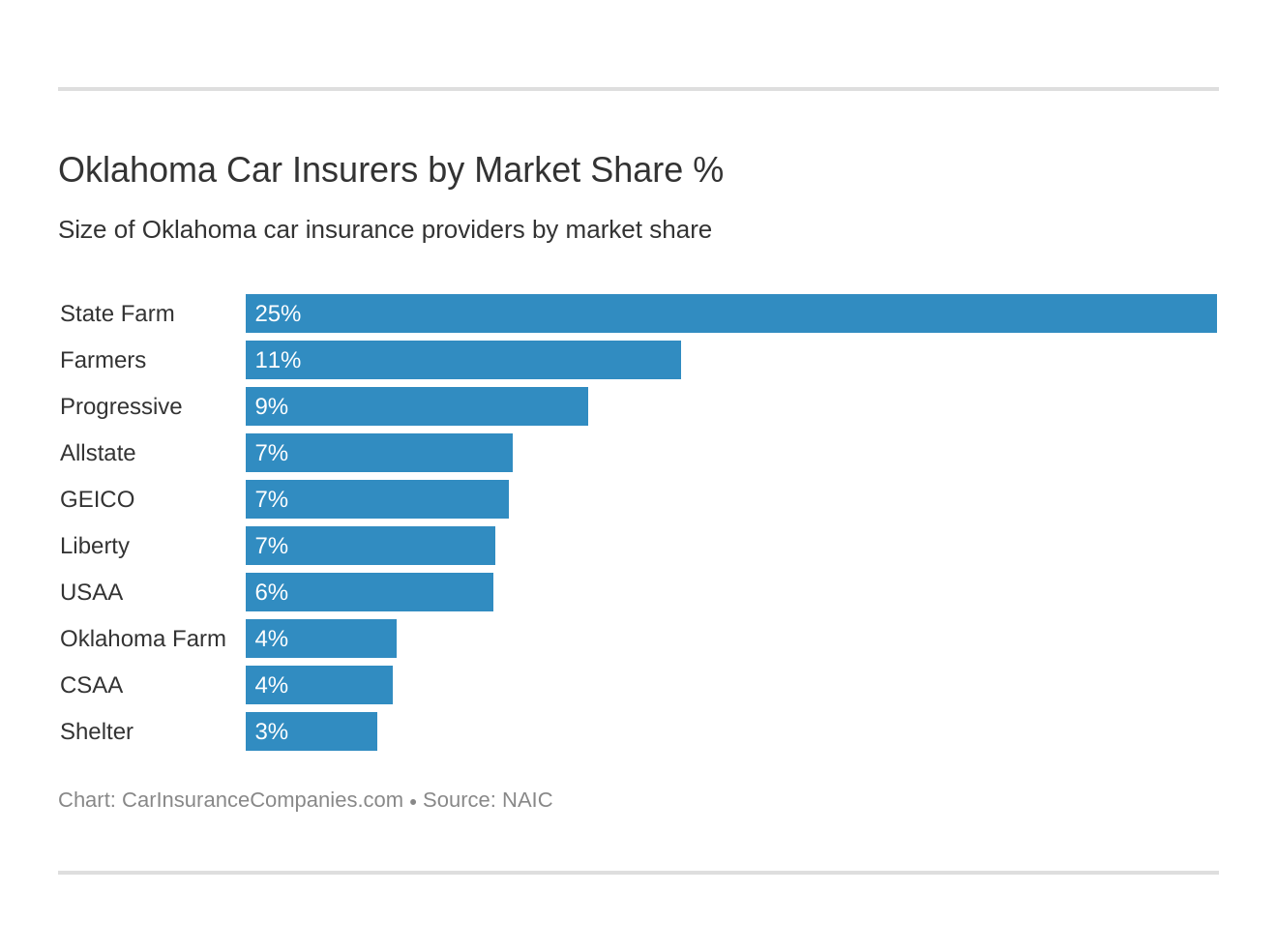

The greatest automobile insurance coverage in Oklahoma will rely upon individual rating factors, such as age, driving document, ZIP code and coverage preferences. However, the following steps could assist you to decide one of the best automotive insurance coverage provider for you. State Farm ties with Geico, receiving the second-highest Bankrate Score on our list.

A single accident might easily exceed Oklahoma’s minimal $25,000 bodily damage coverage per person, forcing you to pay out of pocket for the remaining prices if you're at fault. Your age has lots to do with your car insurance coverage rates. In quick, insurance rates are higher for younger age teams versus people in their 30s and 40s. There are some steps you presumably can take to help your younger driver discover the most affordable automobile insurance coverage out there to them in Oklahoma City. If there are numerous claims from automotive accidents and automobile theft, plus private damage lawsuits in your zip code, expect to see greater rates than zip codes with fewer claims.

Plus, the insurer was awarded an A+ financial energy ranking from AM Best. However, Progressive acquired a below-average buyer satisfaction ranking from J.D. Uninsured motorist protection covers your medical expenses when somebody with out legal responsibility insurance crashes into you. If an at-fault driver has some legal responsibility insurance coverage however it’s not sufficient to cover your damage bills, underinsured motorist coverage kicks in and pays you. Geico and State Farm are likely nice options for good drivers in Oklahoma, so start there if you have a good driving report and you’re purchasing around for the most affordable Oklahoma car insurance coverage.

Nationwide presents a student discount for drivers age sixteen to 24 who keep a B common or better and are full-time college students. When you may have Nationwide as your insurance coverage provider you can bundle your automotive insurance coverage policy with home, renters, boat, and multi-car. By defending your property with Nationwide, it can save you money and simply your life. Oklahoma drivers pay 41% larger rates on common following a DUI, however not all insurers improve rates that a lot. It additionally covers you if you are hit by a driver who does not have legal responsibility insurance.

F-150 house owners can get monetary savings on their automobile insurance coverage expenses with dealer app Jerry. To determine minimal protection limits, Bankrate used minimum protection that meets each state’s necessities. Our base profile drivers own a 2020 Toyota Camry, commute 5 days a week and drive 12,000 miles yearly.

No comments:

Post a Comment